- Equity Shift

- Posts

- How I Would Prep for a 2026 Fundraise (Part 2)

How I Would Prep for a 2026 Fundraise (Part 2)

Building a list of 300+ investors, continuing to network and nurture investor relationships, and taking some time to chill.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

If you read Part 1, then your pitch deck is polished, your financial model is bulletproof, and you've started building relationships with target investors through coffee chats and LinkedIn engagement.

You still have your financial model and market calculations to work on from part 1, but I wanted to share the rest of the process for prepping for a 2026 raise:

The importance of nurturing investor relationships with your monthly updates

How and why you need to build a pipeline of 300+ investors

Touching grass

Star/save this email and return to it once you’ve completed the first 8 weeks.

Let’s dive in 👇🏾

Staying top of mind

Okay, I apologize in advance if this seems out of order. Still, since I closed the last newsletter with advice on how to find your top 50 or high-priority investors and begin establishing relationships with them, I wanted to follow up on that.

Your Secret Weapon: Monthly Investor Updates

Just because you don’t have investors (yet) doesn’t mean you shouldn’t be sending updates. In fact, if your goal is to raise in 2026, I would argue that now is one of the most critical times for you to send monthly updates.

It's easy to reach out to an investor after you've signed your first big customer and have momentum. But it's much harder to tell an investor in your April update that you're planning to sign two customers and launch two new features over the next 30 days, then demonstrate in your May update that you only signed one customer but did launch those features—and customer NPS on those new features is at 90%.

That's the power of consistent updates: you're demonstrating your ability to execute, being transparent about what didn't go as planned, and learning from those experiences. Investors gain confidence in founders who come through on their commitments and are honest about the things that don't work out.

What to Include In Your Monthly Update

Graphic: How to write the perfect investor update.

Your pre-fundraise updates should follow the same structure as post-funding updates, but with a different focus. Here's what to include:

KPIs (3-5 key metrics): Revenue, customers, pipeline, any growth metrics relevant to your business. Include a simple chart of your #1 metric if possible—make it easy for investors to see your progress at a glance.

Business Update (200 words max): Your biggest accomplishment from the month and why it matters. Include one key learning from the month—this shows you're constantly iterating and improving.

Highlights: 2-3 bullet points about wins. New customers, team additions, press coverage, product launches.

Challenges: 1-2 short paragraphs about issues you're working through. This sets up your "Asks" section.

Focuses for Next Month: What each part of your business (sales, product, operations) is prioritizing. This creates accountability for your next update.

Asks: Specific help you need from your network. Introductions, expertise, feedback—be concrete about what would help.

Thanks: Give credit to people who helped you. This encourages more people to lend a hand and shows that you value your community.

Building Your Update List

Don't be shy about who gets added to your investor update list. Include anyone in your community, such as friends, family, former colleagues, and advisors. However, your primary targets while you’re prepping for your raise are the investors you've connected with through the networking strategies outlined in Part 1.

Track Engagement and Build Anticipation

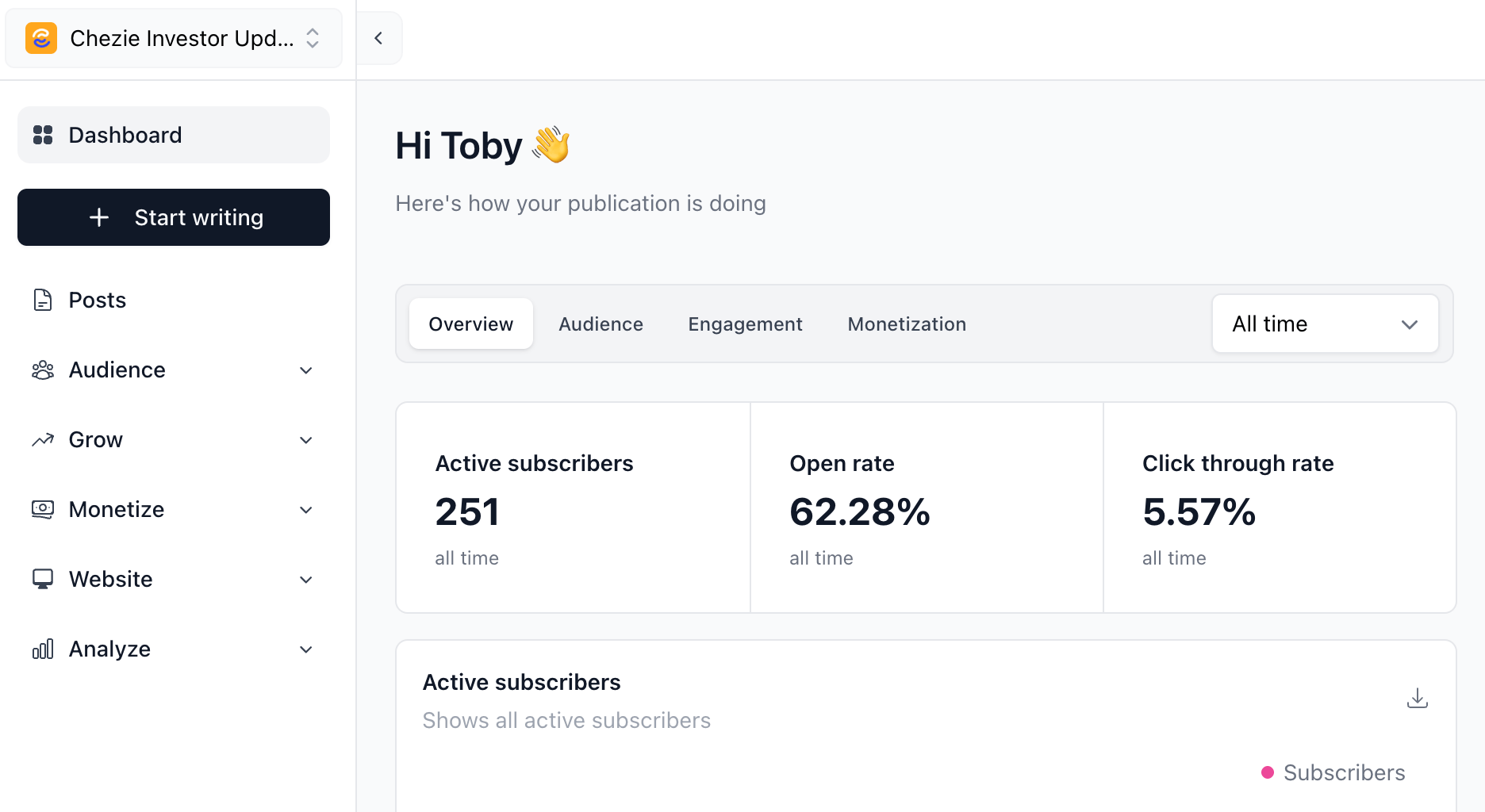

Use an email platform that gives you open and click rates. I use Beehiiv for both my newsletter and investor updates, but you could use any email marketing platform or something simple like YAMM ($60/year). Anything that lets you see who’s opening the updates every month.

Our investor update setup in Beehiiv (peep that open rate 👀)

Two points:

For the purposes of the timeline, plan on sending these updates every 4-5 weeks (the first business day of each month).

Keep the overall vibe positive and momentum-focused, but be honest about challenges and lessons learned.

When you’re ready to capitalize on the rapport you’ve built with investors and ask for an investment meeting, I suggest teasing the raise two months before you kick it off and then, for the investors you're most interested in working with, send a one-off email in early 2026 asking if they have time to chat as you've formally kicked off your raise.

The investors who've been following your progress for months will be much more likely to take that meeting than someone hearing from you for the first time.

Build Your Investor Pipeline (Weeks 9-12)

My investor pipeline consisted of 317 funds. From those 317 investors came:

87 meetings, which led to:

3 checks

Raising VC is a numbers game. For every 10 investors on my target list, I got meetings with only 3 of them—a 30% conversion rate. For every 30 meetings, I got just 1 check. That's a 3% meeting-to-check conversion rate.

Unless you're YC-backed or have a proven track record, don't plan on better than 50% outreach-to-meeting conversion or 10% meeting-to-check conversion.

Work backwards from a typical $2M round:

1 lead investor for $1M

1 follow-on investor for $500k

1 follow-on investor for $300k

$200k in smaller checks from angels and friends/family

That's 3 institutional checks. With a 5% meeting-to-check conversion rate, you need 20 meetings per check. 3 checks × 20 meetings = 60 total meetings. With a 40% outreach-to-meeting success rate, that's 150 investors on your target list.

And for first-time founders? Go ahead and double that number, playa.

This isn't meant to discourage you; it's meant to get your mind right before you start.

Week 9: Set Up Your CRM

You'd never run sales without tracking customers, so don't fundraise without tracking investors.

Open a spreadsheet. I use Notion since you can relate columns to other databases, but Google Sheets or Airtable work too.

Essential columns:

Name of fund

Investor contact (2-3 specific people who make decisions, not general emails)

Website URL

Funding stage (pre-seed, seed, etc.)

Location (don't pitch European-only funds if you're in Atlanta)

Industry focus (don't pitch healthcare VCs your fintech startup)

Check size (know if they write $25k or $1M checks)

Who can intro? (map your connections to each fund)

Get creative with additional columns: portfolio page links, application links (if available), and interaction history.

Week 10: Map Your Network's Connections

Remember: always always always chase the warm intro first. I’ve found that the best way to do that is by starting with your network and identifying funds that you can get direct intros from. Follow this process:

Open a spreadsheet with the following columns:

Person I know

LinkedIn URL

VC Connections

In column A, list my top 20 closest connections that work in tech, startups, or venture capital. These should be CLOSE connections. Like you’d buy them dinner type of close.

Open LinkedIn

For the names in column A (people you know), go to their profile and copy/paste their LinkedIn profile URL in column B

Go to the first person you know’s Linkedin Page

Click Connections

Click All filters

Scroll down to find the Keywords section

In the Company field, enter “ventures”

In the Title field, enter “investor”

Copy each of the names that appears into the VC Connections column of your spreadsheet

Go back to Step 11 and enter “principal”

Repeat steps 11 and 12 for the following title keywords: partner, analyst, platform, associate

Go back to step 10 and replace “ventures” with “capital”

Repeat steps 11-14.

Repeat step 15 with partners, equity, fund, investments

Go back to step 5 and repeat the entire process (steps 6-16) for the next Person you Know in your spreadsheet

Email each connection individually and ask which of their VC connections they’d be able/open to introducing you to (this is why you want to list only close connections in step 2)

Clean up your spreadsheet to include ONLY people you can get introduced to from the People you Know

For each VC connection you can get an introduction to, go to the fund’s website

Check to see that the fund’s thesis (tech, healthcare, B2B SaaS, etc.), geography, and stage match your company

Clean up your spreadsheet to include ONLY funds that match

Email each Person you Know asking for an introduction to [VC connection’s name] at [VC connection’s fund]

Watch as the introductions come through and you book your first 10 (or more) meetings.

Email each connection individually, asking which of their VC connections they'd be open to introducing you to.

This is tedious, but if you do it correctly and are scrappy, it should enable you to reach 50+ funds.

Week 11: Fill Gaps with Databases

Now, use Signal, Crunchbase, and public databases to find the remaining 200 funds for your list. Start with filters matching your criteria:

Location: Your geography or "invests globally"

Stage: Pre-seed, seed, etc.

Industry: Your sector

Active: Invested in the last 2 years

Prioritize funds that have invested in companies similar to yours or in your space recently.

By the end of these 4 weeks, you should have 300+ investors organized by priority, with clear intro paths for your top prospects and database-sourced backup options.

Remember: fundraising is a 95%+ rejection rate game. Without proper tracking and a massive pipeline, even great founders fail to raise capital simply because they run out of investors to approach.

Week 12: Research and Prioritize Funds

At this point, you should have your investor list built out. Now it’s time to prioritize them. For each potential introduction, go to the fund's website and verify:

Geography: Do they invest in your location?

Stage: Do they invest at your stage?

Industry: Do they invest in your sector?

Check size: Does their typical check size fit your round?

Clean your list to include only funds that match your criteria. Tier them:

High-priority: Dream funds you're most excited about OR funds that you can get direct introductions to

Medium-priority: Good fits you'd be happy with

Low-priority: Backup options

This takes us to the end of week 12. By now, all the necessary preparation work is complete. Spend the remaining 12 weeks of the year networking with investors on your target list, starting with the High- and Medium-priority funds.

Touch Grass (Weeks 25-26)

After 24 weeks of preparation, you might feel the urge to keep tweaking your pitch deck or squeeze in more networking calls.

Don't.

The best thing you can do in the final two weeks of 2025 is… nothing.

While most founders enter the holidays anxious about their pending raise, you've earned the right to relax. After six months of preparation, you have everything in place:

A battle-tested pitch deck and thorough financial models

A well-organized CRM with 300+ targeted investors

A network of relationships built through consistent updates

Fundraising is grueling. When January hits and you're taking 3-5 investor meetings a day for weeks on end, you'll need every ounce of mental energy you have. Build up that mental energy and take some time to yourself.

The Bottom Line

The only people who can raise without this level of preparation are second-time founders, those with a YC/Stanford/big tech background, or those with deep VC connections. If that's not you (and it probably isn't), then your fundraising doesn't start in 2026. It starts right now.